Sustainable & Responsible Investments Report

Fiscal Years 2016-2017

The Amherst College Office of Investment and Investment Committee are committed to a dynamic and ongoing process of inquiry, analysis and engagement with Amherst’s investment partners around environmental considerations.

Portfolio Update

$2.2b

Value of the Amherst College endowment for the fiscal year ending June 30, 2017

100%

Percentage of the College’s managers with whom the Investment Office has engaged about sustainability

105

Proxies voted in alignment with environmental, social, and governance (ESG) principles

0

The portfolio has no direct holdings in coal companies

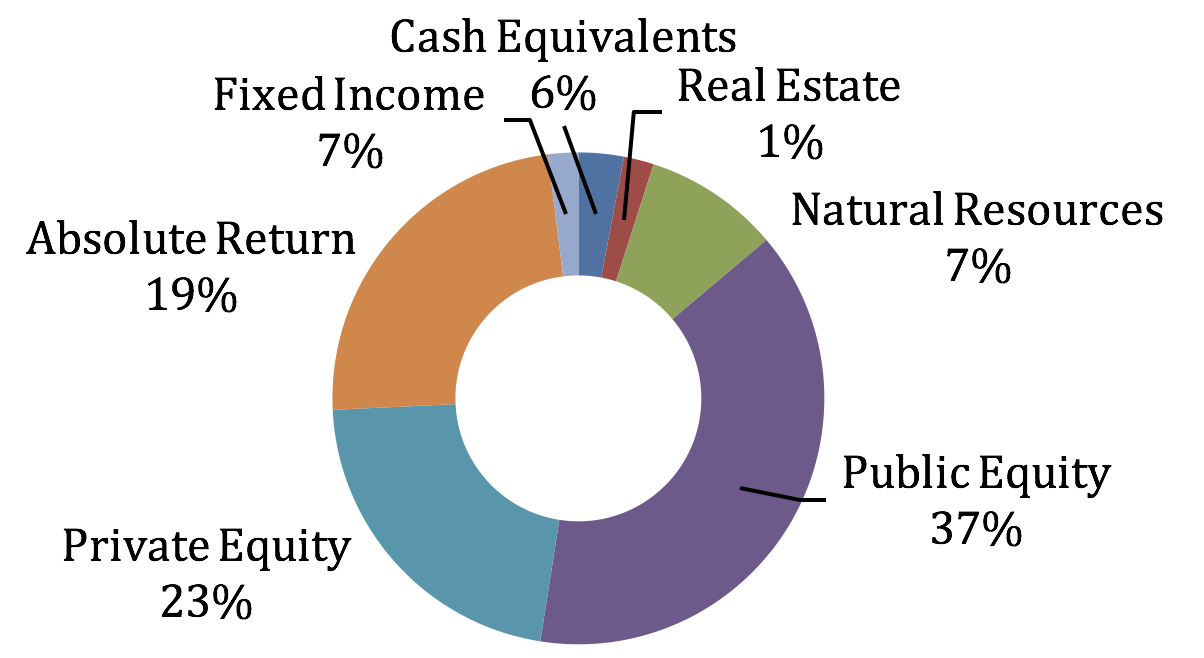

Cash Equivalents 6%; Real Estate 1%; Natural Resources 7%; Public Equity 37%; Private Equity 23%; Absolute Return 19%; Fixed Income 7%.

Existing Manager Engagement

Amherst currently partners with 71 investment managers, spanning a range of asset classes. The Office of Investments and Investment Committee are committed to engaging with our managers. The College continues to have thoughtful dialogue with its managers around the issue of sustainability, and has incorporated a review of sustainability practices into each internal manager write-up.

Sustainable & Responsible Investment Efforts

-

The College consistently evaluates and votes shareholder proxies in alignment with ESG principles, advocating for corporate accountability with respect to social, ethical, environmental and governance issues.

-

In continued partnership with Ceres, a nonprofit organization advocating for sustainability leadership, the College co-signed several initiatives, including: a Global Investor Statement on Climate Change (ahead of Paris COP21), an Investor Statement in Support of the Joint U.S. and Canadian Announcement on Limiting Methane Emissions from the Oil and Gas Industry, an Investor Letter to the SEC about Poor Climate Risk Disclosures and Request for SEC Action, a Letter in support of the continuation of the Regional Greenhouse Gas Initiative, a Global Investor Letter to World Leaders (ahead of Morocco COP22) and an Open Letter to the International Community urging governments to stand by their commitments to the Paris Agreement.

-

The College engages prospective investment managers in dialogue during the due diligence process to understand their approach and commitment to integrating ESG considerations into their investment process. Amherst looks to invest with managers who thoughtfully and consistently incorporate ESG factors into their investment diligence and process.

Proxy Voting

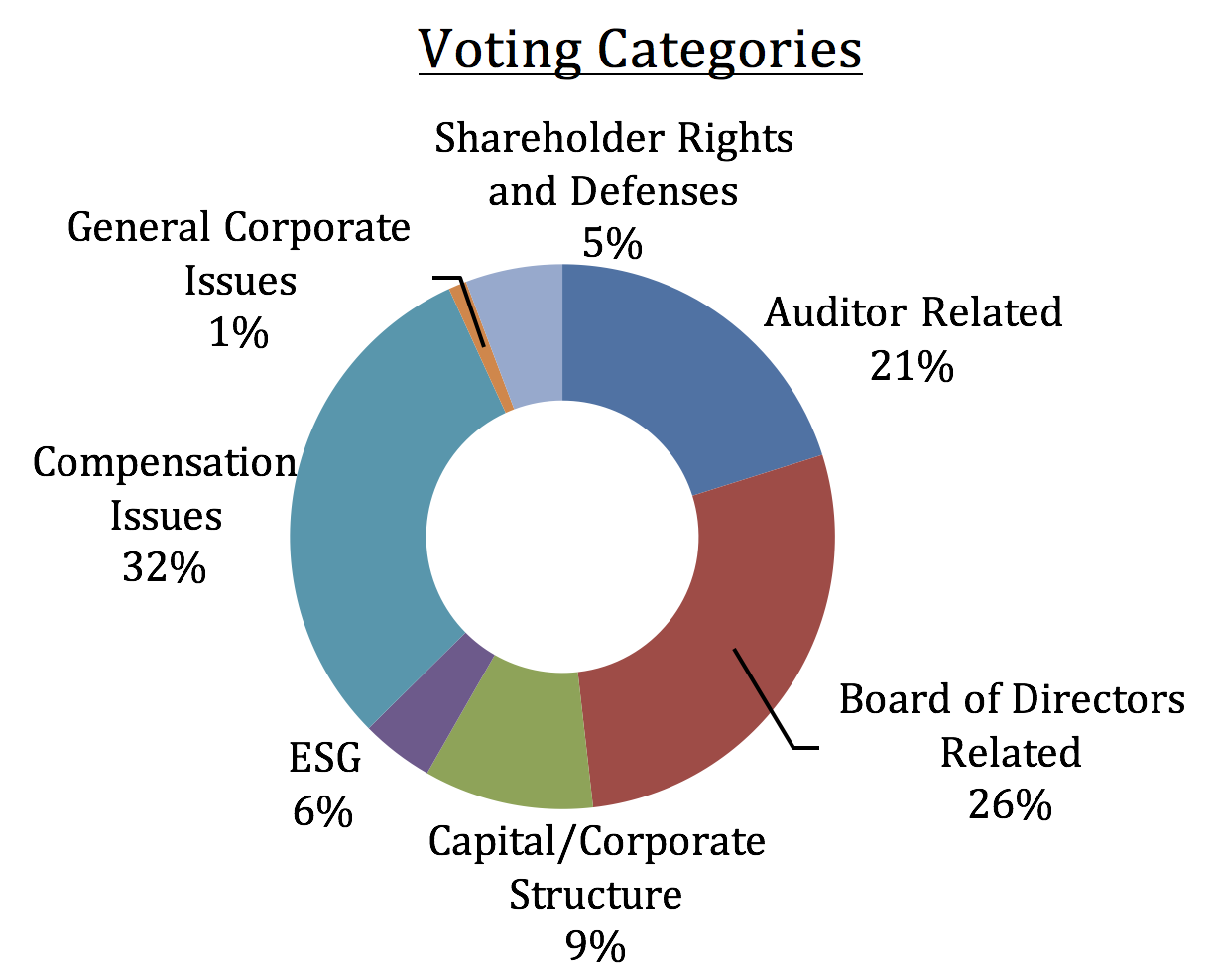

The College continues to use the voting rights attached to the shares of companies in which it invests to promote the principles of sustainable and responsible investment, utilizing research from ISS for all proxies before casting votes in alignment with these principles. In FY 2016 and 2017, the College voted a total of 105 proxies for directly held stocks within the portfolio.

Voting Categories: Shareholder Rights and Defenses 5%; Auditor Related 21%; Board of Directors Related 26%; Capital/Corporate Structure 9%; ESG 6%; Compensation Issues 32%; General Corporate Issues 1%.

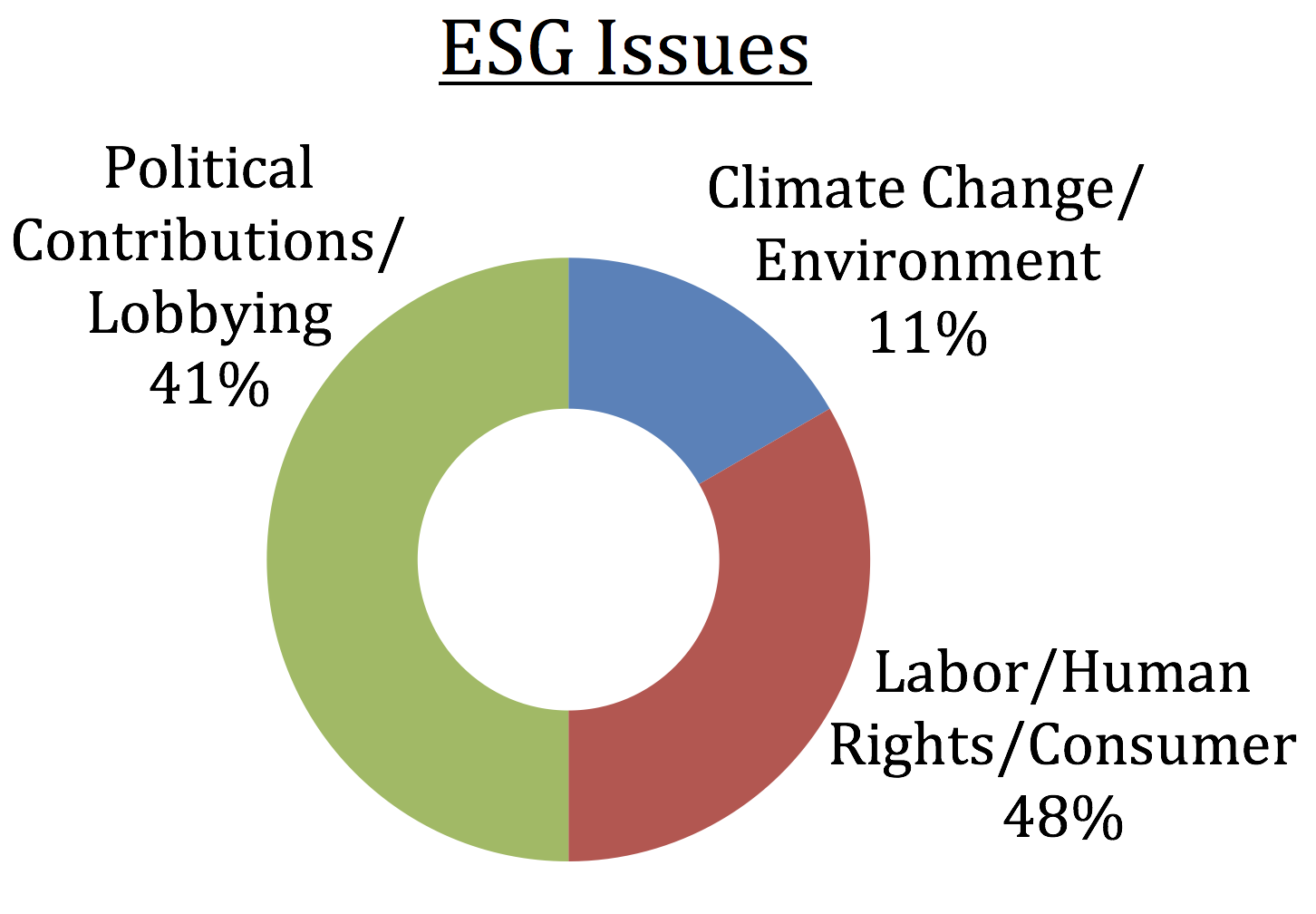

ESG Issues: Climate Change/Environment 11%; Labor/Human Rights/Consumer 48%; Political Contributions/Lobbying 41%.

Of these, 36 proxies included shareholder proposals for a wide range of issues, including reporting on lobbying payments, independent board chairs, gender pay studies and reports on climate benefits of adopting renewable production goals. There were 27 shareholder proposals specific to ESG issues, of which the College voted in favor of all. See the Investment Office website for a complete listing.

Memberships & Other Engagement

|

Name |

Purpose |

Participation |

|---|---|---|

|

EIRIS (Conflict Risk Network) |

A network of institutional investors, financial service providers and related stakeholders calling on corporations to fulfill their responsibility to respect human rights and to take steps that support peace and stability in areas affected by genocide and mass atrocities. |

Member since 2009 |

|

Investor Network on Climate Risk (INCR) |

Ceres’ INCR provides a forum for investors to share information, intelligence, experiences and strategies on integrating climate and other ESG factors into investment decision making. |

Member since 2015 |

|

ISS |

ISS researches and provides recommendations for proxy voting in alignment with social and responsible investment principles. |

Partner since 2007 |